![]()

In the evolution of a business, there may come a time when it is necessary to restructure into a company. Often, non-tax factors will trigger this: government regulations, a need to attract equity investment, corporatisation leading to a potential buyout, or a need to fund working capital.

On the surface, a company rollover appears the ideal option – no CGT is triggered on the restructure, and the same tax attributes, including cost base, are maintained.

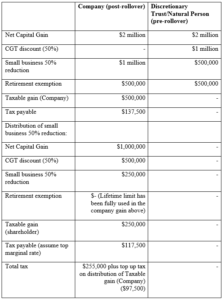

What is not often appreciated is the use of a company rollover can trigger a significant tax disadvantage which should be avoided. This arises because companies are ineligible for the CGT discount, for which natural persons and trusts are entitled. In addition the small business 50% reduction (one of the concessions in the Div 152 small business reliefs) is subject to tax on distribution by a company. For a structure with a single equity participant, the combined effect of these rules is a maximum exempt gain of $800,000 in a company and $2 million for natural persons.

Case Study

A business is operated by the Williams Family Trust (the same result applies if it were operated by a sole trader). George Williams is the controller and underlining owner behind the Williams Family Trust (or the sole trader that owns the business).

The business is considered to have a current market value of $1.2 million. The Williams Family Trust commenced the business from scratch and the cost base of goodwill is Nil. George is looking to introduce a business partner and his accounting advisers have recommended restructuring the business to a company. The restructure is implemented by way of a Division 122-A rollover under which shares with a market value of $1.2 million are issued to George (but under the rollover cost base rules, those shares have a cost base equal to the current cost base of the business, Nil). Note: there will be a cost base in respect of other assets, e.g. equipment.

A comparison of the tax results that would arise if there was a sale of the business immediately before and immediately after the restructure:

In essence, by using the company rollover has converted the unrealised gain on the business of $1.2 million from an exempt trust gain into a company taxable gain with an underlying tax liability on a subsequent sale of around $350,000.

Takeaway

A company rollover may appear simple and give the desired immediate result (nil tax restructure). However, it creates an underlying tax problem.

There are usually alternatives to get a better result. These include the use of the small business CGT concessions in Division 152, or an alternative that does not trigger a taxing event.

When considering a business restructure, contact one of our specialist solicitors for suitable options and expert advice.

By Domenic Festa (Accredited Tax Specialist and Chartered Tax Adviser)

NOTE: This article is for general information only and should not be relied upon without first seeking advice from one of our specialist solicitors.

The post Company Rollover – A Last Resort Option? appeared first on Rouse Lawyers.

No comments:

Post a Comment